Guide to Using SWIFT Codes for Transfers to Mexican Banks

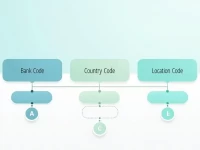

This article explains how to use the SWIFT code MENOMXMTWLS for international remittances to BANCO MERCANTIL DEL NORTE. It provides detailed information on the bank's name, city, and address, aiming to assist users in completing their remittance accurately.